430x

Filetype PPTX

File size 0.17 MB

Source: accelerate.uconn.edu

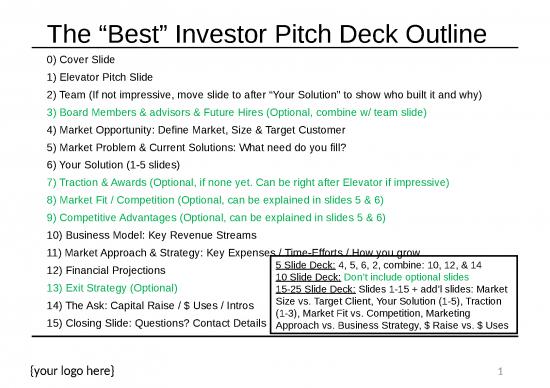

File: Business Power Point Slides 31723 | The Best Investor Pitch Deck Outline

potential appendix slides timeline history milestones prior funding detailed value proposition to clients users partners detailed financials revenue and expense breakdown showing of total revenue expenses average revenue per user ...

![icon picture PPTX icon picture PPTX]() Filetype Power Point PPTX | Posted on 09 Aug 2022 | 3 years ago

Filetype Power Point PPTX | Posted on 09 Aug 2022 | 3 years ago