342x

Filetype DOCX

File size 0.09 MB

Source: www.aer.gov.au

File: Bill Format In Word 30502 | Aer Compliance Check Bill Content, Frequency & Payment Method June Docx

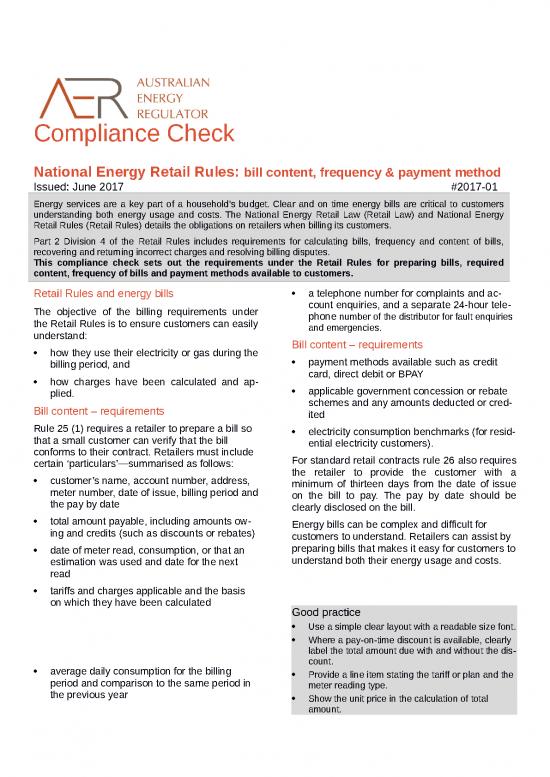

compliance check national energy retail rules bill content frequency payment method issued june 2017 2017 01 energy services are a key part of a household s budget clear and on ...

![icon picture DOCX icon picture DOCX]() Filetype Word DOCX | Posted on 08 Aug 2022 | 3 years ago

Filetype Word DOCX | Posted on 08 Aug 2022 | 3 years ago